Customer Acquisitions in Banking

When it comes to customer acquisitions in banking, there is a lot of competition out there.

Financial institutions have to stand out in the clutter and video banking allows you to virtually build face-to-face relationships while increasing conversion rates.

Video Banking is Moving the Needle for Customer Acquisitions in Banking

Video Chat

+56% greater conversion than text chat

Video Chat and Screen Share

+125% greater conversion than text chat

Video Chat vs. Audio

+87% increase in decision making

Productivity

+38% increase in revenue per banking hour

In a post-pandemic world, banks nationwide are prioritizing hybrid digital transformation to acquire customers, but losing the relationships they need to keep customers long-term.

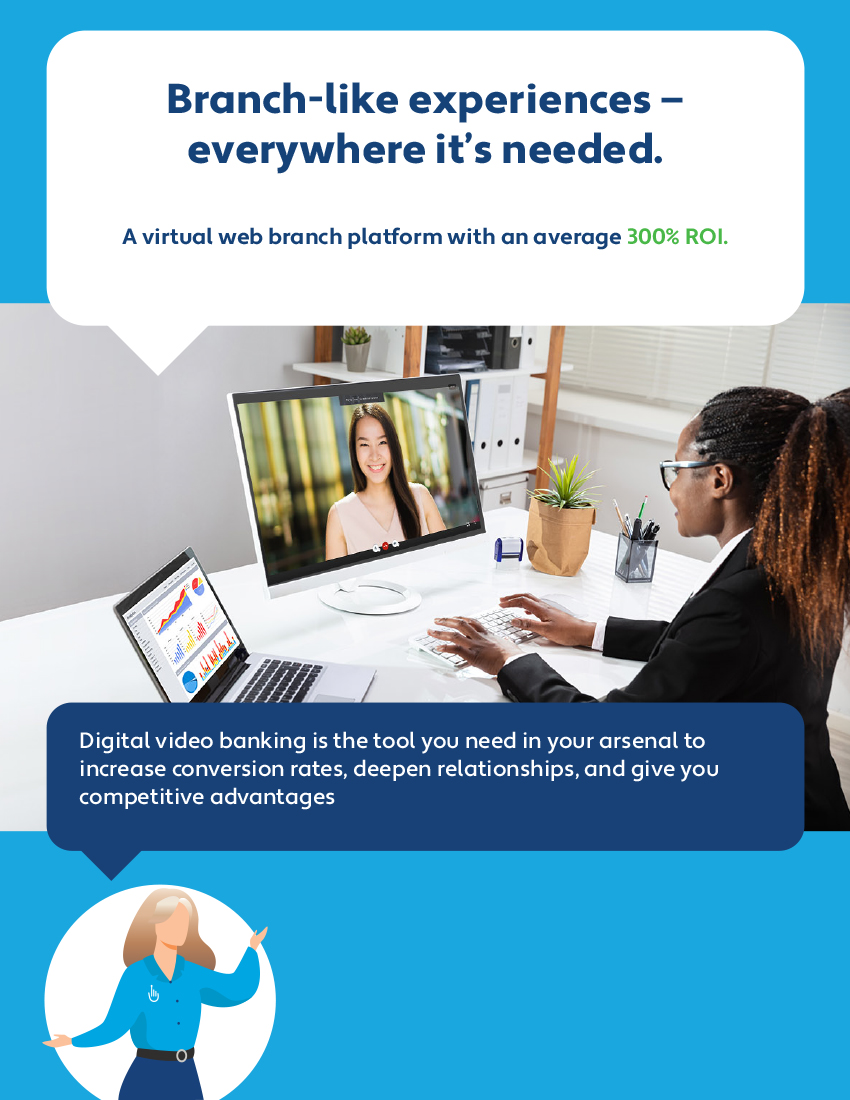

Video banking is the tool you need in your arsenal to increase conversion rates, deepen relationships, and gain competitive advantage in customer acquisitions in banking.

Decrease your number of incomplete online applications with our virtual web-branch platform — allowing you to create branch-like experiences, anywhere and everywhere, with an average 300% ROI. Transform your branches with smart, digital experiences to assist customers during the account opening process.

Increase your online conversion rates and application throughput rates with digital customer acquisition in banking and financial services.

Learn how video banking can increase conversion:

Reduce Incomplete Applications

Reduce application abandonment rate with video chat + screen share. Proactively guide the experience to increase conversions

Product Questions and Advice

Increase online conversion rates up to 40% with video chat readily available on complex, competitive and high-touch product pages.

Geographical Reach

Expand digital sales reach beyond physical branch radius. Build high trust face-to-face relationships virtually.

Emotional Connection

Create memorable relationships vs. phone conversations. 8 out of 10 video banking prospects remember defined characteristics from the conversation vs. 5/10 phone calls cannot remember the name of whom they spoke to.

Cost To Acquire

Reduce costs of channel switching from online to branch to open new accounts. Reduce drop-off rate and support centralized.

Virtual Workforce

Optimize specialized workforce across branch locations and online for immediate new product assistance.

Customer Acquisition Services

Financial Advisors

Wealth Management

Commercial Lending

Mortgage

Auto Loans

Business Banking

Dive deeper into best practices to increase your acquisition efforts in the white paper “Video Banking Best Practices — From Adoption to Implementation”

What Features Do You Need to Create Branch-Like Experiences?

Critical Features to Achieve an Average of 300% ROI.

Testimonial

“The latest video banking technologies shift the consumer experience to a human and digital delivery service across several delivery channels.”

Jon Erpelding, President, NuSource Financial

The best part is — One Touch Video Banking can be up and running quickly; so you can start increasing your conversation rates in less than 30 days, optimizing your workforce across locations, and improving your customer acquisition and banking needs immediately.

Let’s move the needle!