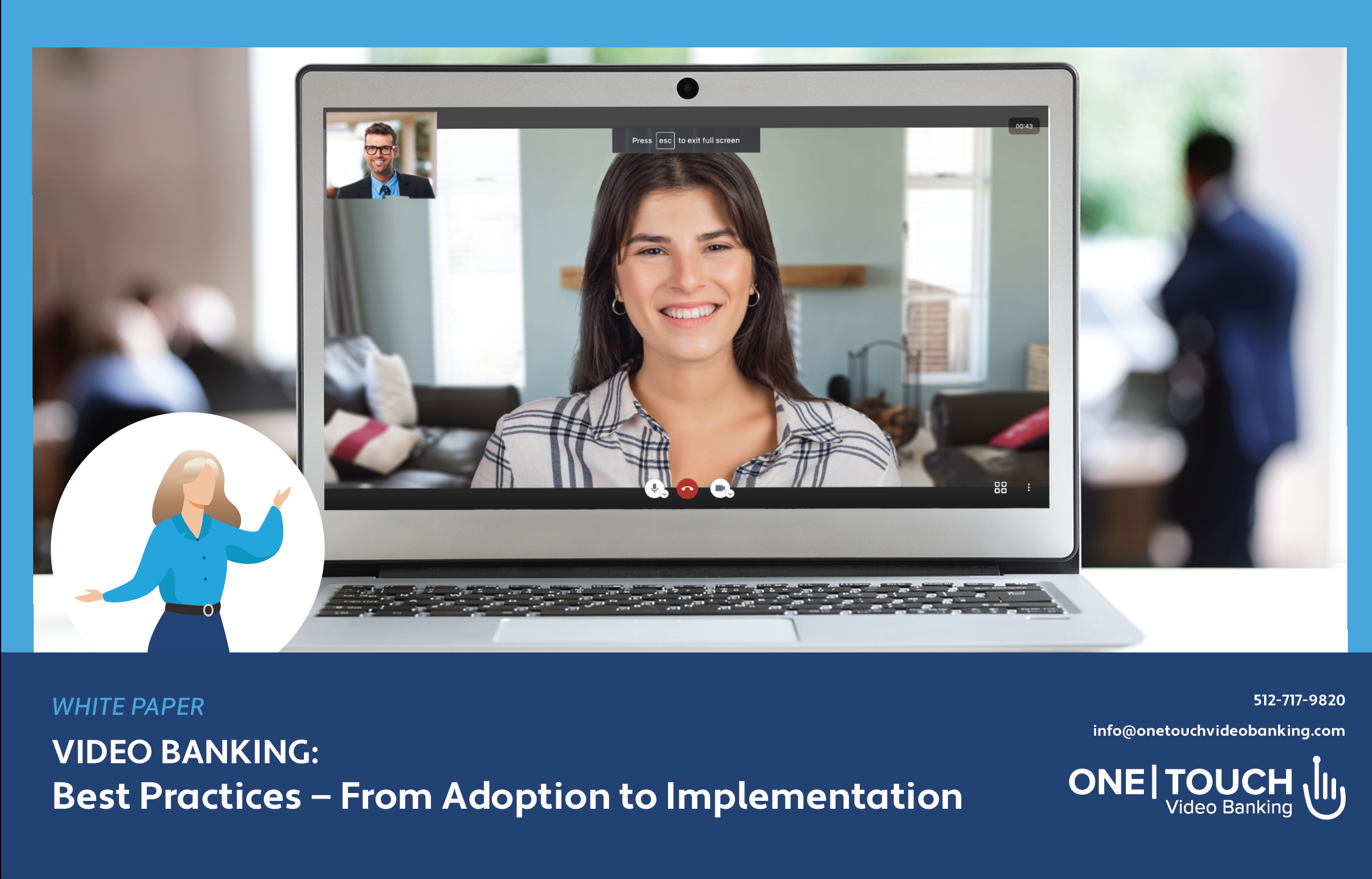

This video banking best practices white paper will not only show you where the top opportunity areas are throughout your organization, where to start, and what ROI you should expect — but also how to be successful in your implementation of video banking.

A glimpse of what is inside the Video Banking Best Practices white paper:

- How The Pandemic Accelerated Digital Adoption

- What is Video Banking?

- Video Banking is NOT Video Conferencing or Video ITMs

- Why the Rise in Video Banking?

- In Your Customers Shoes: They Value Convenience & Time

- Top 10 Reasons Executives Are Implementing Video Banking

- Digital Experiences Throughout the Entire Journey

- Creating High-Touch, Face-to-Face Engagements

- Top Video Banking Applications

- Optimize Staffing Across Locations

- Video Banking For Digital Servicing

- Video Banking For Digital Acquisition

- Video Banking is Moving the Needle

- Key Ingredients for a Successful Video Banking Strategy

- Video Banking ROI

- 100% White Labeled Customer Experience

- Browser-Based

- Beyond 1:1 Video Calls

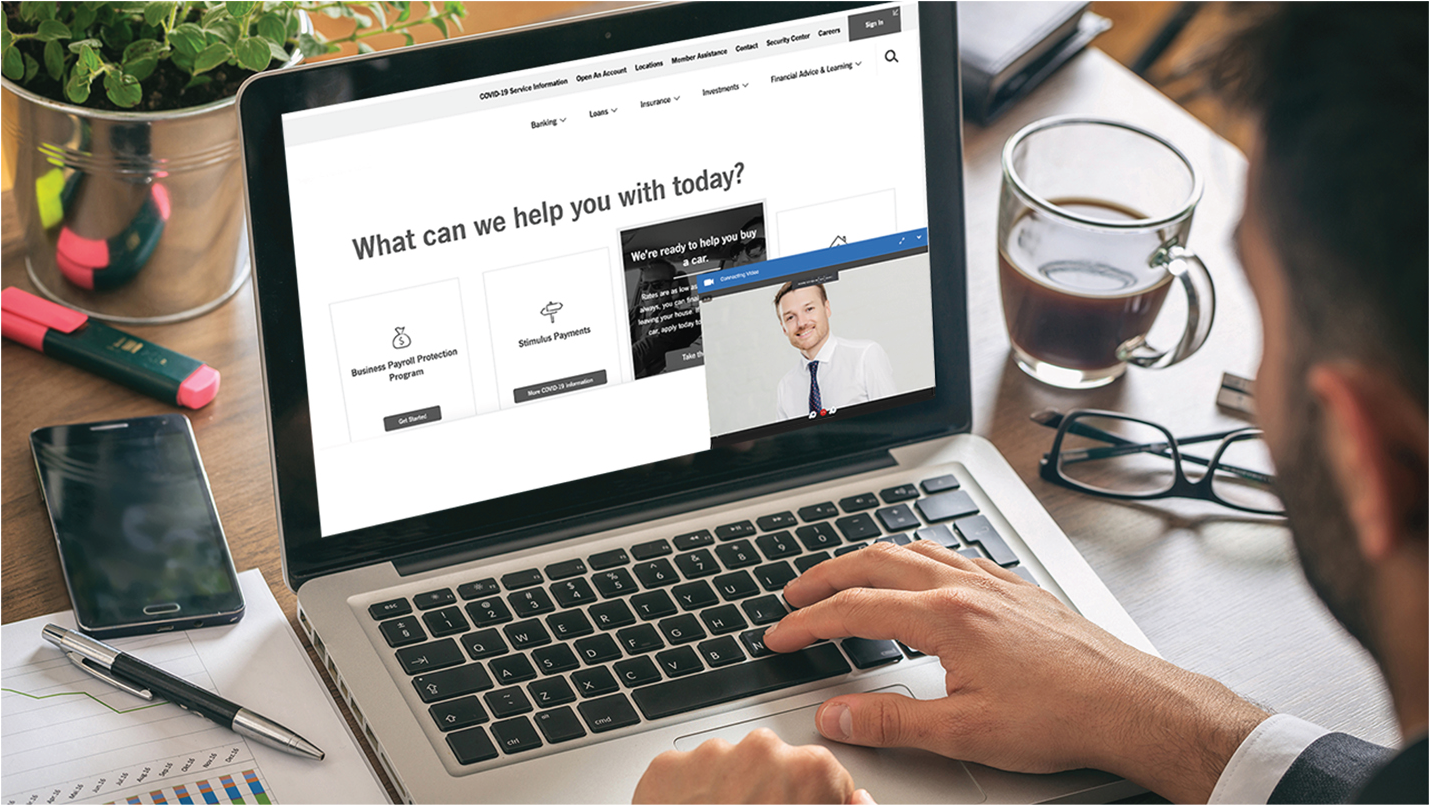

Increase your online conversion rates and application throughput rates with digital customer acquisition in banking and financial services.

Learn how video banking can increase conversion:

Reduce Incomplete Applications

Reduce application abandonment rate with video chat + screen share. Proactively guide the experience to increase conversions

Product Questions and Advice

Increase online conversion rates up to 40% with video chat readily available on complex, competitive and high-touch product pages.

Geographical Reach

Expand digital sales reach beyond physical branch radius. Build high trust face-to-face relationships virtually.

Emotional Connection

Create memorable relationships vs. phone conversations. 8 out of 10 video banking prospects remember defined characteristics from the conversation vs. 5/10 phone calls cannot remember the name of whom they spoke to.

Cost To Acquire

Reduce costs of channel switching from online to branch to open new accounts. Reduce drop-off rate and support centralized.

Virtual Workforce

Optimize specialized workforce across branch locations and online for immediate new product assistance.