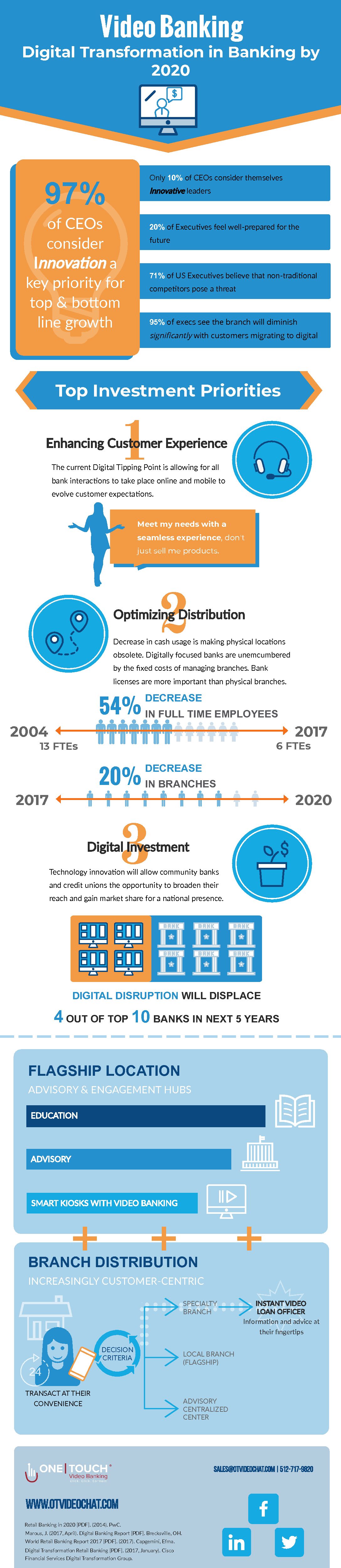

4 out of the top 10 banks will be displaced in 5 years.

There has been a lot of buzz lately on the digital transformation in banking and what will banks and/or branches look like in the next two years. The US has always followed the technology trends of the UK and if that says anything, we’re in for some major digital transformation in banking around the corner.

Our infographic shows some great research information by leading companies such as PWC, Cap Gemini, Efma, Deluxe, and others consolidated into one easy to read infographic on what’s to come.

Digital and mobile banking have changed the way customers interact. These new channels will continue to shape customer expectations and allow new players to enter into financial markets. Banks are no longer competing against themselves, they are competing against non-traditional banks and fintech companies alike. No longer is the need for branch real estate as the branch license is key for digital expansion.

A few of the top banking executive priorities that are highlighted in the infographic:

The Key to Rising Above the Competition: Innovation

Executives surveyed believe that innovation is the key to staying competitive and increasing top & bottom line growth. However, only 10% of Financial Leaders consider themselves innovators and only 20% feel prepared for the future.

So what do Leaders need to consider when investing for the future?

Customer Experience

Banking customers are looking for a seamless customer experience. They’re looking for solutions, not sales pitches. If a product meets their needs based on a holistic picture and a human approach, that’s where real growth and relationship building originates. It’s no longer ok for banks to market prospective customers through digital channels while making them come into a physical branch to open an account or apply for a loan. Customer experience starts with the acquisition and continues to get them to increase wallet share.

Branch Distribution

Between 2017 and 2020, it’s projected that in the United States we will see a 20-30% decrease in branch locations. However, in the UK in 2017, over 50% of the physical branches closed, resulting in 9100+ branches. That means banking executives need to be aggressively thinking about how to segment branches and re-imagine the branch experience. As the number of employees per branch continues to decrease (13 FTE’s in 2004 to 6 FTE’s in 2017), centralizing specialty operations such as private client/wealth management, loans, and other areas allows for scalability.

Digital Investment

With customers migrating to digital, 95% of banking executives see the branch diminishing significantly over the next couple of years. Community banks and credit unions have a huge opportunity to innovate and gain market share as many are not as burdened with legacy systems. Using digital technology allows regional players to be national players overnight. If you market and acquire customers digitally and can back it up with a digital customer-centric experience, the burdensome costs of brick and mortar go away. Estimates predict that digital disruption will displace 4 out of the top 10 banks in the next 5 years.

How will trends shape the Bank of the Future?

The physical footprint will still play a role, but it will evolve to primarily be digital. Banking executives will need to come up with a hybrid model.

A flagship location will be the hub with smaller locations serving specialty roles for education and advisory. Video banking will play a key role in connecting branch employees from branch to branch, while also connecting with them digitally for their convenience. Decision criteria will take into account the customer’s needs and direct them to the best specialist.

Want to see the “near future”? Check out our video on the current branch customer journey vs. the future digital customer-centric journey.