Digital mortgages in 2018 will be a pivotal year for the large banks, lenders, credit unions and regional banks. If the last 7 years are a similar trend, by 2022, non-depositary lenders could take almost all the loan origination volume from the big guys.

The Digital Mortgage Customer Infographic highlights some of the following:

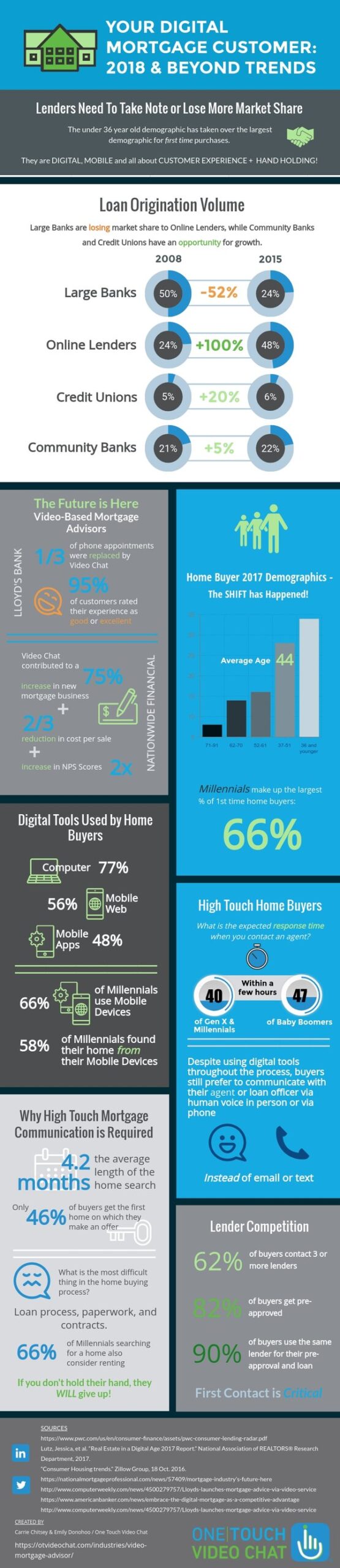

- Large Banks have lost 52% market share in 7 years

- Community Banks have stayed pretty much the same to a slight increase of 5%

- Online lenders have grown 100%, primarily due to consumers’ demands for online and digital mortgages.

- Credit unions have increased by 20%

The home buyers’ age is getting younger as more Millennials are buying homes. The average age of the homebuyers in 2017 was 44 years old. And over 50% of home buyers were under the age of 36 years old.

The days of going into your local bank have come to a halt and according to the PWC, consumers are weighing more on technology, advisor experience, and availability than localization.

Over 82% of today’s digital mortgage customers are getting pre-approved when looking for a home. With over 33% of buyers contacting more than 3 lenders. This drives the fact that the first impression is by far the most important in this highly competitive space. Considering the fact that most banks have centralized their loan officers and they are not in the branch or at least not in every branch, that first contact is usually via phone or email.

Long are the days of meeting in person, looking someone in the eye and working with them locally. It was highly cost intensive to do that, however, the close rate and competitive advantage were much higher. Consequently, today’s digital mortgage customer still prefers phone and human touch to email and text messaging. Why? The younger demographic is all about being authentic and knowing someone.

Video mortgage advisors have been used in the UK for the last couple of years and have had significant increases in revenue and reduction in costs.

Video mortgage advisors are here in the US already and making a big dent in the competitive advantage. Imagine being able to see someone, have the human connection right through their smartphone. Imagine the realtor connecting their video mortgage advisor with their clients sitting at the table of the house they want to put an offer in on, getting that pre-qual in minutes?

Those days are here! Whether you are a large bank, a small bank, or an online lender, everyone wants a piece of the high-margin mortgage loans. So how do you increase your revenue, broaden your reach and reduce your costs? Connect your digital mortgage customers with a video mortgage advisor, bring back the human touch during the much-needed stressful process. Take the anxiety of buying a home from the younger demographic and give them peace of mind seeing the human behind the loan with a video mortgage advisor.

To learn more about video mortgage advisors:

- Read the White Paper “The State-of-the-Art Video Approach for Lending as a Service (LaaS)“

- See Video Lending for Banking

- Watch a Demo

Digital Lending eBook | What's Inside

- What is Video Lending as a Service (LaaS)?

- Top 3 ways Video Lending Advisors can increase conversion rates.

- Two case studies outlining an average 1,380% ROI by adding video lending advisors to their acquisition efforts.

- Increase 1003 applications providing instant access to loan officers to your realtor and builder relationships.

- How video advisors go beyond approvals and throughout the processor and servicing journey.

- 100% White Labeled Customer Experience

- Browser-Based

- Beyond 1:1 Video Calls

About One Touch Brands